- July 28, 2023

Azure Data Warehousing Solution for Peer-to-Peer Lending Data

Introduction

This case study focuses on a financial peer-to-peer company that successfully implemented an Azure data warehousing solution to address its data management and analytics challenges. With a growing volume of financial data and the need for scalable and efficient processing, the company turned to Azure for a comprehensive solution. By leveraging Azure Data Factory, Azure Data Lake Storage, and Azure Synapse Analytics, the company achieved improved data ingestion, transformation, and modeling

Problem Statement

The Client faced the challenge of efficiently storing, managing and analyzing their massive and ever-growing dataset. The existing infrastructure struggled to cope with the scale and complexity of the data, impeding timely decision-making, and hindering accurate risk assessment. The client needed a robust and scalable solution to process and analyze their peer-to-peer lending data in near real time.

Methodology

1. Data Ingestion

Azure Data Factory was utilized to efficiently ingest data from various sources, including loan applications, credit bureaus, financial institutions, and internal systems. Data pipelines were set up to extract, transform, and load the data into Azure Synapse Analytics.

2. Azure Synapse Analytics

The client leveraged Azure Synapse Analytics as their centralized data warehousing solution. Synapse Analytics enabled seamless integration with other Azure services and provided scalable compute and storage resources to handle the large volume of peer-to-peer lending data.

3. Data Modelling and Storage

Client’s data was organized into a logical data model within Azure Synapse Analytics. The data was stored in dedicated SQL pools, ensuring efficient data retrieval and query performance.

4. Advanced Analytics

Azure Synapse Analytics enables the client to perform advanced analytics and derive actionable insights from their lending data.

5. Data Visualization

The data will be presented in an interactive dashboard that will allow users to explore the data and gain insights on Default customer, Bankruptcy customers, Average loan score, Amount funded and Amount received.

6. Scalability and Cost Optimization

Azure Synapse Analytics provided client with the flexibility to scale their compute and storage resources based on demand. This ensured cost optimization by paying only for the resources utilized during peak periods.

Benefits & Results

1. Enhanced Data Processing

The client achieved faster data processing and analysis, enabling quicker loan application approvals, improved risk assessment, and streamlined business operations.

2. Actionable Insights

The advanced analytics capabilities of Azure Synapse Analytics allowed the client to extract valuable insights from their lending data, enabling data-driven decision-making and improved risk management.

3. Scalability and Cost Efficiency

Azure Synapse Analytics’ scalability allowed the client to efficiently handle their growing dataset, while optimized resource allocation resulted in cost savings and improved operational efficiency.

4. Future Readiness

The Client’s Azure data warehousing solution provides a solid foundation for future growth and innovation. They can easily incorporate additional data sources, expand

analytics capabilities, and explore advanced technologies like AI and machine learning to further enhance their lending services.

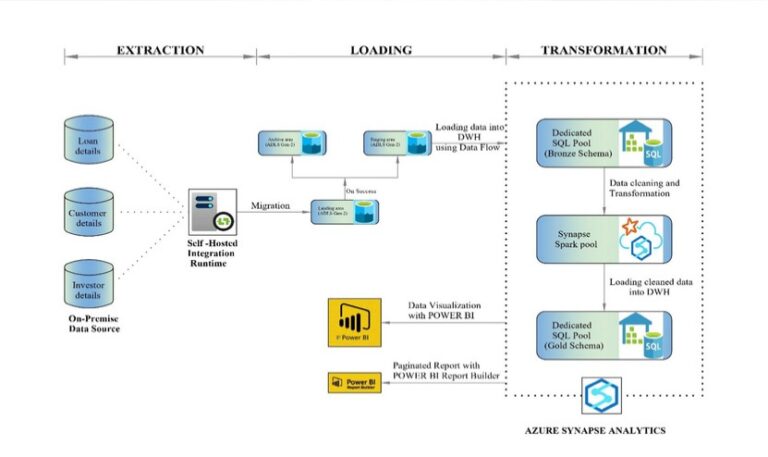

Project Architecture

Our Approach

Extract

The raw data of Lending Club Loan details is extracted from the website and stored in an on-prem file system which is subsequently migrated to Azure cloud which is connected using self-hosted integration runtime. The extracted data is then staged into ADLS-Gen2 container.

Load

Using Synapse analytics pipeline with get metadata and copy activity storing all the data into dedicated SQL pool in Bronze Schema.

Transform

Using Spark Pool Cleaning and Transforming the data. Lastly loading clean data into dedicated SQL pool in Gold Schema using Synapse Spark pool.

Visualize

The data is then visualized using Power BI, which allows for the generation of paginated report and dashboard for the purpose of gathering insights.’